F Reorganizations in Lower Middle Market M&A

Lower middle market (“LMM”) M&A transactions frequently involve F reorganizations (“F reorgs”) of S corporations (“S-corp”). F reorgs are often a critical part of structuring the purchase and sale of S corporations. If you plan to take your S-corp LMM business to market and anticipate the transaction will be structured as a stock sale, you will likely encounter buyers seeking to structure the deal as an F reorg. How should sellers view an F reorg and what are the implications of this type of transaction structure?

Why Are They Used?

In short, to maximize a transaction’s tax benefits and minimize risk. M&A transactions can be structured as a stock sale versus an asset sale for a variety of reasons, including buyers facing a competitive M&A market and being forced to acquiesce to a seller’s request for a stock sale or the target possesses difficult to transfer contracts, licenses, or assets. When a buyer acquires an S corporation and wants to maximize its depreciation or amortization deductions after the acquisition, it will generally need to choose between several alternatives: an F reorganization; a section 336(e) election; or a section 338(h)(10) election. Each allows the treatment of a stock sale as an asset sale for U.S. federal income tax purposes. However, both the 336(e) election and the section 338(h)(10) election requires a valid S election for basis step-up. Unfortunately, it is not uncommon for S-corps, particularly older S-corps, within the LMM to inadvertently blow their S-corp election status[1], a risk that buyers have a difficult time mitigating. Further, both the 336(e) election and the section 338(h)(10) election limits the ability of a seller to achieve a tax-deferred rollover of their equity in a transaction. In the section 338(h)(10) election, the buyer must acquire at least 80 percent of the total voting power and value of the stock of the target in a taxable transaction a qualified stock purchase (“QSP”), while under the Section 336(e), the seller must sell at least 80 percent of the shares in the target, by both vote and value in a taxable transaction a qualified stock disposition (“QSD”). Restructuring S-corps using an F reorg can solve many problems that may impact the buyer’s ability to get a step-up in basis or the seller’s ability to achieve a tax-deferred rollover.

How They Work

Despite the “tax and legal jargon”, an F Reorg is relatively simple to consummate. The basic steps include the following:

- The equity holders of the S corporation target company form a new corporation (“Newco”)

- The shareholders then contribute all of the equity of the S corporation target company to Newco in exchange for equity of Newco (the S corporation target company is a wholly owned subsidiary of Newco at this stage, and the former equity holders of the target company are now the equity holders of Newco)

- Newco then makes a Form 8869 tax filing to treat the target company as a “qualified subchapter S subsidiary” or “QSub”, to make Newco a permissible owner of the target company

- Newco makes a filing to convert the target company (“Oldco”) from a corporation to an LLC

- Once the F reorg is complete, the buyer purchases the equity of the target company (which is now a single member LLC (the “Target LLC”) that is treated as a “disregarded entity” for federal income tax purposes)

Potential Benefits for Sellers

Many LMM businesses have been structured as S corporations, an entity type that offers tax benefits, such as corporate income and gains being taxed once, at the shareholder level, while losses, deductions and credits get passed through to the shareholders, among other benefits. As a result, S corporations have become one of the most predominant forms of business organization in the LMM. LMM buyers frequently encounter targets structured as S-corps and M&A transaction structures of stock sales for S-Corps often include F-reorgs to achieve a pathway for a buyer to obtain a step-up in tax basis while avoiding potential issues with the target’s historic S election.

Satisfying a buyer’s desire for the tax benefits of a step-up in tax basis is nice, but what is in it for the seller? The primary answer is in preserving the tax-free rollover of equity for sellers. Many buyers in the LMM request or require that sellers retain some portion of ownership in the business as part of the transaction to create alignment. (Note: read our article on rollover equity for a deeper discussion on why rollover equity is a factor in deals). If the rollover amount in the transaction is around 20 percent, taxpayers may have an issue with the section 338(h)(10) or section 336(e) election because the IRS may disagree on the valuation of the stock and the QSP or QSD may be challenged. If the section 338(h)(10) or section 336(e) election turns out to be invalid, the taxpayer will not receive the step-up in basis. In an F reorg, there is no limitation on the rollover amount or amount that must be acquired in a taxable transaction, providing flexibility.

Our View

LMM M&A transactions involving a company with difficult to transfer contracts, assets, licenses, employment agreements, or regulatory approvals, will likely result in a stock sale. Because of the proliferation of S-corps within the LMM, F reorgs are a common feature of the landscape. As a business owner of an S-corp you should be aware of this structuring technique and understand the general benefits of the F reorg prior to negotiating a transaction. If your buyer insists that you rollover some equity in the transaction, the F reorg helps ensure that the rollover’s tax-free treatment is preserved. While the structure is well-known and the steps to complete an F reorg are relatively simple, there can be complicating factors that should be evaluated by tax experts. An important feature of the F reorg is treating the stock sale transaction as an asset sale for U.S. federal income tax purposes. Sellers should be aware that depending on the assets contributed to the Target LLC, sellers may recognize both capital gains and ordinary income. The buyer can provide a gross-up to account for the extra taxes (including additional state taxes) compared to a stock sale. A seller’s ability to ask for and receive the gross-up is a matter of negotiation driven in large part by the competitiveness of the M&A environment and the nuances of the deal valuation and structure negotiations.

Vail Valley Asset Management – Full Service Investment Management for Business Owners

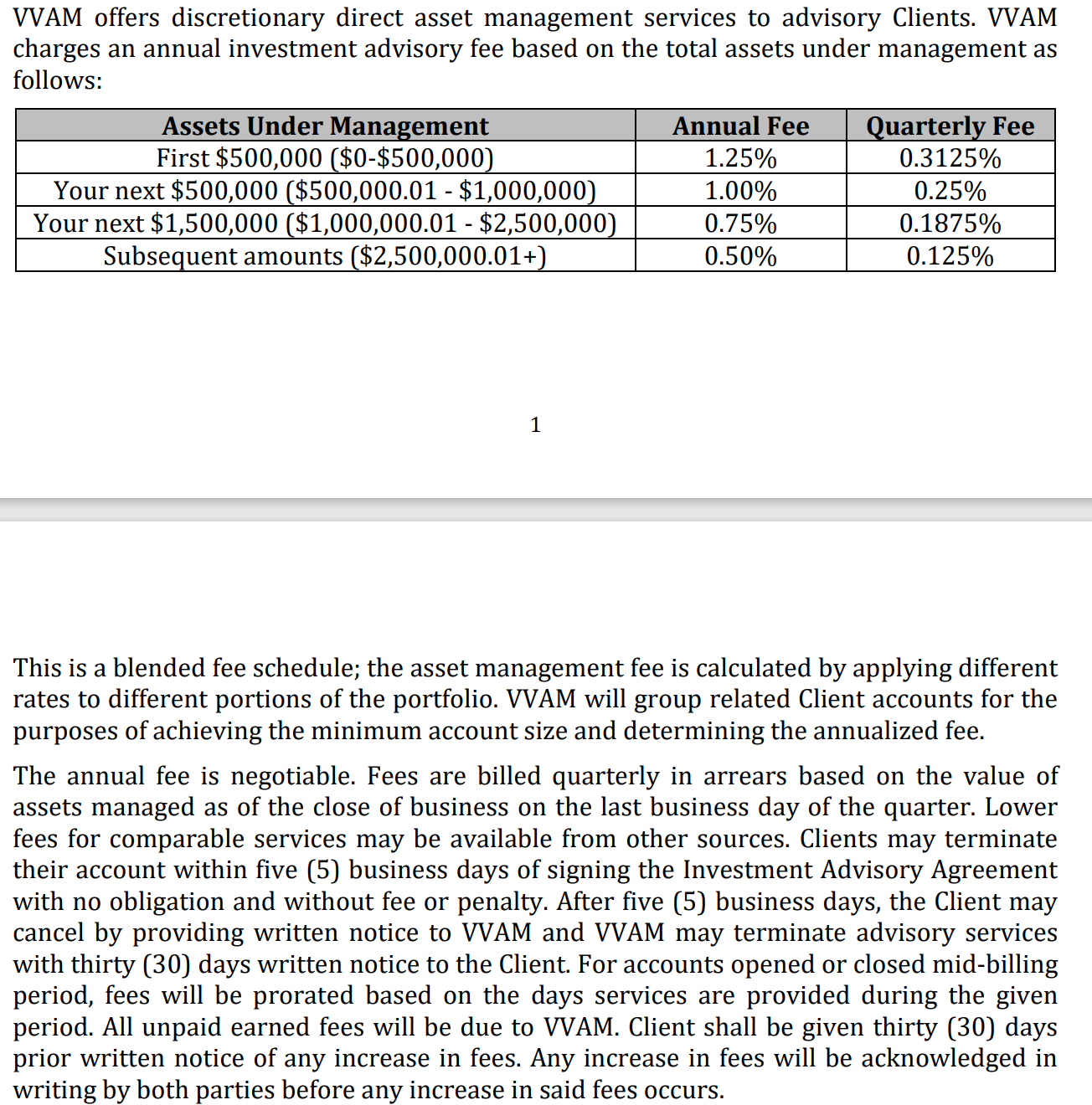

We offer a highly differentiated investment solution for lower middle market business owners centered around our unwavering commitment as fully aligned fiduciaries. We view our clients’ business ownership as their most important asset that is at the core of our portfolio management process. At Vail Valley Asset Management, we are 100% fiduciary 100% of the time, and offer a source of objective advice to business owners. Building and operating a business is complex, requiring dedication, vision, and perseverance. Selling your company attracts sell-side service providers motivated by success fees and other deal-related fees. You deserve a trusted and unbiased advocate with a deep understanding of private markets to guide you through the complexities of the M&A process. If you are a business owner looking for a financial advisor with expertise in private markets and the M&A process, contact us at Vail Valley Asset Management to schedule a consultation.

[1] Some of the disadvantages of the S-corp classification is that the corporation is limited to 100 shareholders or less at a time, only one class of stock is permitted, and all shareholders must be “eligible”, which generally includes individuals, estates, and certain trusts. The “one-class-of-stock” rule applies to economic rights of the S-corp shareholder and requires that all equity owners receive allocations of income and loss (as well as distributions of cash or property) in strict proportion to their ownership percentages. It is common for an S election to be invalidated because of disproportionate distributions, failing to get spousal signatures for taxpayers living in community property states, or transfers to ineligible shareholders. Blowing an S-corp election will trigger a reversion to a regular C corporation status and its second layer of taxation, which could have a severe financial effect on the business owner. Buyers planning to use a section 338(h)(10) or section 336(e) election will often review the past five years of Forms K-1 to ensure that the rules of subchapter S have been respected.

Disclaimer – The views expressed are the views of Sean Abbey, CFA through the date of this article, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. This is also not intended to be tax or legal advice, consult with your tax and legal experts for specific guidance related to your situation. References to transactions and concepts, specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. © by Vail Valley Asset Management, LLC. All rights reserved

Read Next

Get Started.

To determine if VVAM is the right fit for your needs, fill out the form to begin a dialogue with our team.

Vail Valley Asset Management, LLC is a Registered Investment Advisory firm located and registered in Colorado. * The firm’s services are not available in all states and the firm may need to seek additional registrations before working with a client in a state in which it is not presently registered.

© Vail Valley Asset Management | All rights reserved.